Alternative ownership options

We all want to own an aircraft. But if you are like me, the checking account (and my spouse) will not always agree to spend all my (her) extra money on supporting my personal aircraft (toy).

And I’ve tried it all, “But honey, all I have to do is stop going to Starbucks for coffee twice a week!” It doesn’t work — especially if you are married to an accountant (although, she is a recovering accountant and she should be over most of this money detail stuff in a few years). For years I have said, “You can sleep in your aircraft, but you can’t fly your house!” Just as a reminder, that doesn’t work either — unless you really like sleeping in your plane, but that’s another story.

Through the many years of buying and selling aircraft, I have looked at all the alternatives. Yes, I like ownership and no I don’t like to share, but sometimes I need to. And since I’m always shopping for another aircraft, I’m sort of always “shopping” for another method of ownership. And one way is to have someone help you pay for the expenses.

My fantasy “partner” is someone who wants to own an aircraft but doesn’t have any plans to fly the aircraft. You know the kind, an owner who is one of those people who has to own an airplane but doesn’t have the time or maybe not even a license to fly an airplane. Yes, it is probably a fantasy. I have heard of partners like that, but they seem to be like the “P-51 in the barn” stories. You always hear about them, but they never happen to anyone you know or much less to you.

Partnerships can be incorporated or limited liability as well as singular ownership, but most of these “business” variations are more for the owner’s tax and liability situation than for cost advantages.

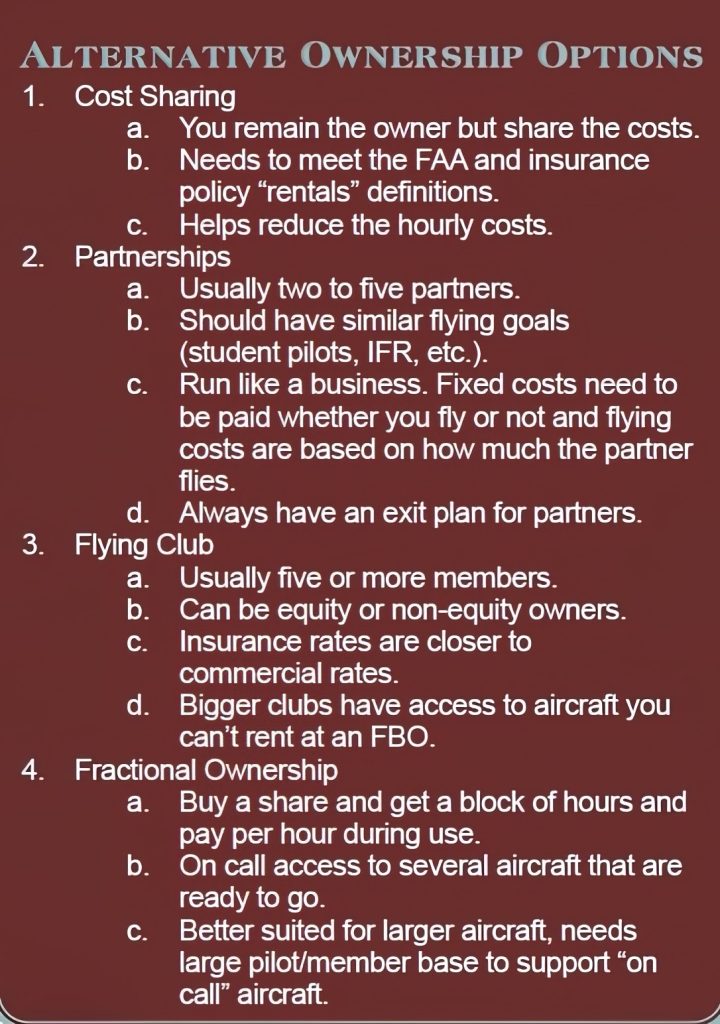

Sharing Costs, Not Ownership

Before we get to partnerships, maybe a better option is to just share the cost of operating the aircraft. In this case maybe the owner could just share the costs of owning the aircraft with another person or several people, but not share the actual ownership of the aircraft. There are a couple of problems associated with sharing the costs that need to be addressed. The FAA is one and the insurance underwriters are the other. Neither is impossible but both are important factors in the cost-sharing picture.

Before you “share” check out the FAA guidelines. Typically, the language about sharing the costs, or being reimbursed for the cost of the aircraft, can be found in the FAR Part 91 section of the FAA regulations. It has always been understood and implied that reimbursement or sharing of costs was just for the fuel and oil. But you and I know that it costs more than that to own an aircraft. What about the maintenance, hangar rental, and insurance?

Sharing the costs means “charging” the other pilots an amount for using the aircraft. This amount might be by the hour and include the cost of fuel and oil or it might be a set amount that excludes fuel and oil. Either way it looks a lot like rental and there are limits from the FAA and the insurance underwriters as to what type of “rental” you as a noncommercial owner can charge. Make sure you refer to the FARs and your insurance broker to make sure you are sharing the costs correctly.

Let’s set up an example. I own an aircraft and I decide to let my friends use the aircraft. The friends agree to pay me for the use of the aircraft. They will reimburse me for the cost associated with their use on a “per hour” basis and I make them buy the fuel they use. If I am going to charge the users for more than the fuel and oil, I may be skirting with commercial rental rules. Commercial means that the FAA could require that my aircraft go through a 100-hour inspection program (and other requirements) in addition to the annual inspection. Let’s say the FAA agrees with your plan — the insurance company might not. Most insurance policies will have some sort of exclusion about the lack of coverage for commercial situations (unless the policy is specifically for that purpose). But on a positive note, there are a few insurance policies that will allow for “limited rental” situations.

The pilot who uses your aircraft might have to be named on the policy specifically as a pilot or meet the open pilot warranty. Adding any kind of limited rental to a policy, even if it is approved with the FAA, might increase your premium. Not to belabor the point, this can be a great way to share the costs, but make sure you investigate all the rules (and risks) first. Don’t listen to the airport lounge gossip, get the facts for your aircraft and insurance underwriter.

Partnerships

The first real alternate ownership option is to have a partner or partners. These could be all equal shareowners in the aircraft, or you can divide the shares based on a factor like how much each partner will use the airplane. The partners share the purchase price, operating expenses, and repair expenses. This is a wonderful way to cut down the personal financial outlay — if you get along with your partners. I have been around a number of partnership arrangements that have been very well designed. I’ve met owners who keep a calendar at the airport and the local FBO actually manages the scheduling of the aircraft for them. They made a deal where the partners call the FBO and they book the aircraft, just like renting from the FBO. It’s a first-come, first-served basis. Interesting enough is that they also have set up a “per hour” rental rate that each partner pays to the aircraft fund. This enables the partnership to keep the aircraft bills paid and they never argue over who owes what when the bills come due. They also don’t argue over the flight times. Many a partnership has been ruined because one person flies more than the others and he doesn’t pay any more than the others. This way the per hour cost covers the bills. Of course, there are little details that need to be worked out if one pilot doesn’t fly very much. Usually that entails a minimum amount that the partners pay during the year. That way the partners will still have enough money to pay the fixed expenses even if they didn’t put very many hours on the aircraft.

One thing to remember about partnerships: they are more than just a handshake and need to be run like a business. There are fixed costs that need to be paid by everyone whether the plane flies or not. And there are other costs that are based on how much the partner flies. The partner who flies more, pays more. And the one who flies less, pays less. You would not believe how many partnerships have been “dissolved” because one partner felt they were paying more and flying less and it “wasn’t fair.”

That brings up the question of how to dissolve the partnership if a partner moves, loses their job, has to stop flying due to health, or dies. That’s something that needs to be decided on at the very beginning.

I have recommended that partners buy some sort of term life insurance to cover each owner’s share of the aircraft. The reason is we have had partners who have died and their share then reverts to their estate or spouse. They (the spouse or estate) don’t want the aircraft so they want their share bought out. Often that is not possible. But if you buy a life policy and make the partners or partnership one of the beneficiaries, it can help cure that problem. Make sure you get more details from a life insurance agent to see how it would work in your case.

Flying Clubs

From an insurance standpoint, the partner category lasts until you get more than five partners, then you jump to a flying club status. By increasing the number of people who are owners, the cost to own is reduced. But that also increases problems with scheduling, maintenance, insurance, and more. A flying club is almost like renting an aircraft from an FBO. If the club has enough members to keep the cost down, the members can’t get the aircraft they want, when they want it and in many cases the aircraft is not maintained the same as a personal aircraft. But for many people, flying clubs are the way to go.

Leaseback

Another option is the leaseback arrangement. This option is when the owner of the aircraft puts the aircraft at an FBO and lets the FBO lease the aircraft. An advantage of this is the FBO gets an aircraft to fly and the owner gets a legitimate business aircraft. Since the number of pilots is far greater than the number of aircraft it’s a sure deal that people will rent aircraft if they want to fly. Leaseback arrangements are presented to new buyers as a very efficient way to develop rental income and reduce monthly operating costs. And in some cases, there might be cash savings.

To take advantage of the lease arrangement the owner should put the aircraft on the flightline and get their check at the end of the month. By that I mean you aren’t planning on flying the aircraft yourself. If it is your personal aircraft, you will be in for a shock. The disadvantage is that the aircraft is a rental aircraft and will get the treatment of a rental aircraft. The students are going to land it hard and leave it dirty. Plus, if you want to fly it, you have to rent it. You’ll call the FBO and schedule it just like everyone else. It is a rental! If you want to take it for a weekend adventure, you should be paying for the down time. If that is not what you want for your aircraft, don’t put it on a leaseback. A personal plane needs to stay personal. A leaseback aircraft needs to be a piece of business equipment. The people who are unhappy about leasebacks are often the ones who expect the renter and FBO to treat the aircraft like they would and that’s not going to happen.

Fractional Ownership

Basically, fractional ownership means the owners buy shares of the aircraft. With the cost of the share they get a specified number of hours of flying time at a lower rate than normal. They also pay a monthly fee and when they use the aircraft they pay the hourly fee. Fractional ownership has been very popular for large corporate aircraft. Buying a fraction allows the buyer to get use of more aircraft than they might be able to afford on their own. Additionally, they can often buy more than a single fractional ownership, thus giving the buyer different aircraft options without the expense of total ownership. Fractional ownership usually includes the crew and all the amenities to go along with it. This is a program that is usually targeted at the high dollar, top end owners. Often, we are talking corporate situations where the owner is not a pilot or won’t be flying the aircraft.

You probably won’t see fractional ownerships in a Cessna 172, but you will see partnerships. Whatever the method, if the ownership costs are reasonable, you’ll fly more and still enjoy the world of aviation.