Photo by Jack Fleetwood (www.jackfleetwood.com)

Are you thinking of changing your flying habits? Maybe you want to go higher or faster, or maybe just take more friends. Whatever the reason, changing your aircraft requires you to look into all the factors that will affect your purchase. This includes insurance, changes in operating costs, training requirements, and your home airport. Also to be considered is pilot personality, attitude, use, and personal preference.

Thinking a twin is the next step?

Many a pilot has seen an old twin sitting on the ramp that was a “great deal.” These are usually cheap aircraft to buy. And many competent people have paid good, hard-earned money for an old twin only to discover that the insurance company wants more money than the purchase price for the premium. Of course, that is if you can get insurance at all.

Let me give you a few examples. A Piper Apache 160 was offered for sale for less than $25,000. What a price! And what a cheap twin to operate. For a low-time pilot who wants to get a multi rating it is the perfect time builder for the Midwest flatlands.

But there was not an insurance company that would insure the aircraft. Think about it: The twin Apache uses two 160-hp Lycoming engines. If the Apache lands gear up or has a nose gear collapse, the cost to overhaul the engines or just work on the crankcases and crankshafts would be more than the total value of the $25,000 purchase price. This would be considered a constructive loss and the insurance company would have to total it. So instead, they just decline to quote the risk.

Or, how about an 800-hour, instrument-rated pilot with a multi-engine rating but only 10 hours of multi who buys a Cessna 421. The insurance company wanted the buyer to attend an approved school and get 30 hours’ dual prior to solo. (Just a note here, this was the lowest of the requirements! Other companies wanted 50 to 100 hours of dual, prior to solo.) The company also wanted a premium of just over $12,000 a year! Ouch.

What if you want a Malibu?

Well, I have examples for that too. Recently an insured wanted to move up to a turboprop aircraft. There was only one underwriting company that would even quote the risk. That company wanted a premium of $15,000 for a $600,000 aircraft. While that seems like a lot, the rates used were quite competitive, and it was better than nothing. Additionally, that pilot was required to get 50 hours of dual. You read that right. Fifty hours of dual prior to solo. Basically, this requirement meant hiring a full-time pilot just to get the dual instruction.

If you are thinking of a jet, another recommendation would be to accumulate as much turbine time and multi-engine time as possible prior to purchasing. One common requirement among the underwriters for getting into a jet (and understandably so) is the pilot must be multi-engine and instrument rated. A few underwriters did recommend having high-performance twin time. The thought is multi-engine hours in a Piper Apache are not as valuable as hours in a Cessna 421 or a King Air.

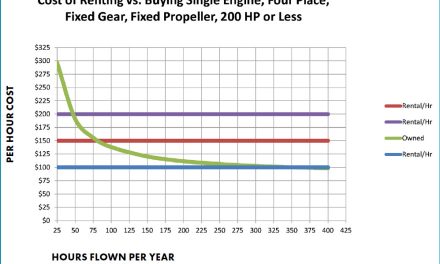

Cost to operate

Maybe you aren’t planning on buying a fancy late model pressurized aircraft. Maybe what you want is an old Navajo. Good for you! But let’s be realistic about this. First, remember the insurance problem discussed earlier!

Also, the bigger, faster and more complicated the aircraft, the more it costs to operate. Let’s review the operational cost “rule of thumb”. The cost of operation for a light single is about two times the fuel cost per hour. Example 10 gph time $2 per gallon equals $20 per hour in fuel. Take that times two and you get an estimated cost of about $40 per hour. That’s a basic operating cost that doesn’t include insurance, hangar, principle or interest. A heavy single has a multiplier of two and a half or three and a light twin has a multiplier of four.

Remember those numbers. Any time you move up the ladder of aviation you need to consider the cost of operation. But there is more to it than that. If you are a transition pilot, you’ll need extra training and school to get insurance. Sure, the FAA says you’re qualified to fly that particular aircraft, but the finance company requires insurance and the insurance company says it won’t insure you without extra training. And it does not matter if you are buying a twin, a big single, or even a tailwheel. The insurance company will want more training. They always do.

If you are starting small and moving from a small fixed gear to a small retract, get some experience. The more retract time the better. And it really doesn’t matter if it is in an Arrow or a 172RG, retract time is retract time. What the underwriters want to see is retractable hours and a signoff in your logbook.

Start small

If you are taking the major step and moving up to a twin or a large retractable gear aircraft, think instrument. Most insurance companies don’t want to provide insurance on complex aircraft to a pilot without an instrument rating. From the twin side, often smaller is better. That means an aircraft like the Aztec. Except for the fact that the older the twin aircraft the harder it is to get insurance.

Whenever possible, go out and get your advanced ratings or checkout prior to buying an aircraft. The underwriters like it when some other insurance company has the rental airplanes insured while you’re getting your rating. This gives the buyer experience without the underwriter of their aircraft taking all the risk. How much should you fly? Shoot for about 25 to 30 hours in a “like” rental aircraft before buying. Not only does it make it easier to buy insurance, it helps lower the first year’s rates. Of course, the big challenge in this plan is finding and renting a “like” aircraft!

Training costs money, too

If you are buying a twin, expect at least 15 hours of dual and your multi-engine rating prior to solo. Then expect 10 hours of solo prior to hauling any passengers. And if you decide to buy a turbine expect anywhere from 50 to 100 hours of dual (if you have only piston time) and don’t forget factory school and annual training. Again, turbines fall into a whole different class. The underwriters want lots of hours, lots of training, and then, if they like you, they might insure you, but don’t buy until you price the insurance. If you do get insurance for the turbine and you are low time, the premium will reflect it. But as I have said before, it is only money.

Talking piston aircraft, this means you’ll be adding another $1,500 to $2,000 (or more) for the instructor to train you. That also means we’ve spent all this extra money without even paying the expenses on the aircraft. And the bigger and more complicated the aircraft, the more likely it is the underwriter will require formal school (Flight Safety, ATM, etc.). If you are sure that you want that aircraft, you might want to take the factory-approved formal training prior to the purchase, if at all possible.

One other thing. If you want to move up the aircraft ladder, check out your very own airport. If you fly off grass, don’t buy a retractable gear aircraft or a twin. Not many underwriters like this scenario. If you fly off a short field, make sure the underwriter approves. The typical guideline is 1.5 times the takeoff or landing over a 50-foot obstacle (whichever is longer). If your airport is close to the minimums, make sure the underwriter approves it. Don’t get caught without coverage.

What steps can you take to move up?

- Get your instrument rating. If you buy a turbocharged or pressurized aircraft, you’ll need it. Most companies will not insure a non-instrument pilot in a T or P aircraft. If you have to have the turbo and you don’t have an instrument do not buy a pressurized aircraft! Non-instrument-rated pilots have a better chance of insurance in a non-pressurized but turbocharged aircraft. But it will cost you. Instruments are not a necessity for all aircraft and the savings amount to about 5% of the premium so act accordingly.

- Buying a multi? Take a “cram” course and get the rating before you buy the aircraft. The insurance company will look more favorably towards an already licensed multi-engine pilot. Of course, you still need hours. Just the rating isn’t the cure. If you can, rent time in a twin, do it. Hours are a major key to lower rates and insurance.

- No retractable gear time? Go to the local FBO and get the checkout and start renting the retractable gear aircraft. The more hours the better. If you can put in at least 25 hours before you buy. More is better. And don’t forget to put the wheels down!

The old line says, “there are those that have and those that will!” Don’t be either!

Insurance can be a very prohibitive part of aircraft ownership. Cost of the insurance and training requirements can be a large percentage of the operating cost, especially for the first year.

If you don’t have to borrow the money or need to buy insurance, the only requirements to follow are the FAA minimums. If you go into the new purchase without the ratings and experience, the aircraft can be not only dangerous, but can cost more to operate. But if you get the training prior to the purchase, not only will your flying be safer, it will be more fun and insurance rates (if you buy insurance) will be lower.